Introduction

We are at the start of a confusing, unpleasant year. Global growth is expected to be sluggish in 2023, according to the IMF’s annual economic forecast. There may be multiple factors at play in the upcoming year, including the COVID-19 outbreak and its long-term consequences, rising inflation, and tighter monetary policy. In a fast-changing world, where all major economies are facing external and internal pressures, there is a consensus among economists about an upcoming “partial recession” and an uneven recovery shortly. Union Micro, Small and Medium Enterprises Minister Narayan Rane said that there is a global recession and it is in many countries. The recession is expected to hit India after June. Let us now understand the impact of the recession in the year 2023 through this blog.

Global IT Market in 2022

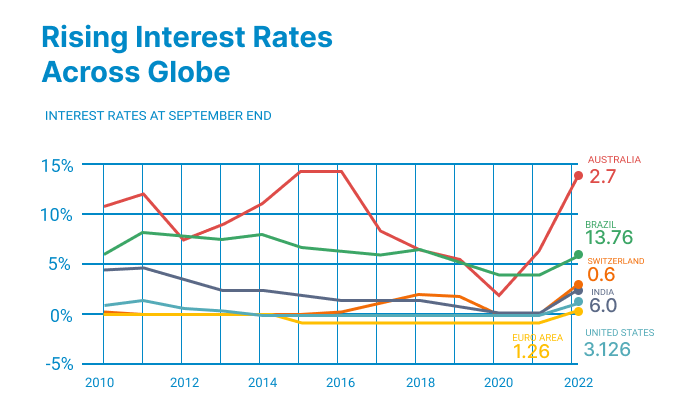

In the industry of technology, the last year 2022 was marked as a year of great loss for tech companies. There was a trillion dollars loss in the market value. There were many reasons behind this which include Russia’s invasions of Ukraine, covid-19 pandemic, and inflation-increasing interest rates. Various industries such as cloud computing, social media and semiconductors lower their future projections and experience a decrease in stock prices. 7 major tech companies like Tesla, Netflix, Facebook, Google, Microsoft, Amazon, and Apple also saw a loss of over three trillion in combined market value.

Layoffs

Many technology companies across various industries lay off employees at a rapid rate. The same rate was during covid-19 pandemic. However, according to an estimate, the tech sector has cut over 150,000 jobs in the last year. This includes large companies like Facebook’s parent made-up platform, Amazon and smaller businesses in the US. However, the Indian IT startup layouts were on the rise. It reported over 15,700 employees lay off due to tightening funding conditions.

Global Recession likely to be in 2023

According to the WEF report, inflation over the last year was broad-based and stubbornly high. Also, the inflation data released in the final quarter by many countries provide some space for optimism over the medium-term inspiration of look in 2023. The report highlights that there is a need to bring inflation closer to the 2% target without choking off growth but the challenges will run deeper. Also, precious food, energy and inflation may be picking up according to the world economic forum. Also, some economists including the South Asia region, India and Bangladesh benefit from global trends such as the diversification of manufacturing supply chains from China. At the same time, WEF said businesses are expected to cut the cause significantly In response to economic headwinds.

Predictions

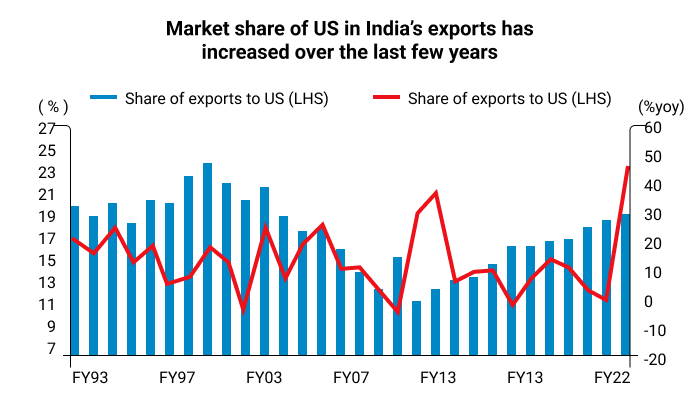

Nearly 20% of respondents now believe that a global recession is extremely likely -to be double the number from the previous survey – but each region also exhibits significant variations. In the Middle East, North Africa, and South Asia, most chief economists predict moderate or strong growth, while in the US and Europe, more than 9 out of 10 predict weak growth. In November and December 2022, the Forum’s economic briefing brought together chief economists from the public and private sectors to discuss their thoughts and expectations. According to the World Bank, a global recession will hit the world in 2023, causing GDP growth to slow down to 1.7%, the slowest pace since 1993 outside of the recessions in 2009 and 2020. Also, the market share of the US in India’s exports has increased.

Impact of recession on India

It is expected that globalization will start at the beginning of the year and last throughout the year.

- India’s exports to the United States have grown over the years. But due to the recession, India was impacted and only managed to survive the financial crisis of September 2008.

- India’s economy is projected to reach $10 trillion by 2035, ranking third globally.

- A mild or deep recession in the US will eventually affect the entire world, as the country is one of the world’s great superpowers.

- Indian business has a significant outsourcing agreement with US clients but a slowdown in the US economy was undoubtedly terrible news for India.

What will be the economic outlook for India in 2023?

The international monetary fund projected that global growth will slow down from 3.2% in 2022 to 2.7% in 2023. In these situations, all the central banks are generally moving towards a tight landing rate theory which can further slow down global growth. However, its impact on India is showing merchandise exports in October fell by 12% and went up less than 1% in November. Additionally, in 2023 it is expected a global growth slump will play a big role and influence domestic growth from January to June. Moving forward the outlook of wheat production is positive with higher support prices according to RBI.

If there is a recession in 2023, what would it mean for investors?

Recessions do not mean investors cannot make money. If you know where to look, any market offers opportunities for you to take advantage of. When economic growth is low or nonexistent, large companies tend to perform better than smaller ones. There are generally fewer supply chain disruptions in big companies, and their revenue streams are more diversified. Companies with fewer employees can struggle. Those who do not generate significant profits can struggle to recover from a drop in revenue, and companies that aren’t generating significant profits can face even greater challenges.

Conclusion

As the global economy gets impacted the most, the overall impact of the United States on India would be minimal in 2023 as the factors drive growth more towards local places. Over the past couple of years, the fear of an economic slowdown in the United States has increased. However, this resulted in an economic crisis slowdown with a significant lowering in growth estimates.

+44 141 628 8980

+44 141 628 8980

(786) 269-2247

(786) 269-2247

+61 872007153

+61 872007153

+91 8900027268 (Sales only)

+91 8900027268 (Sales only)